- Hotline +65 6631 8332

Navigating Financial Waters: How to Deactivate Paytm Postpaid and Revive A Suspended Paytm Account

Saturday, 28 Oct, 2023

This article is a part of PayCEC payment insights

Follow PayCEC - global payment gateway to get updates on the latest payment trends and ecommerce news

What's inside?

We'll look into why a Paytm account is deactivated and how to prevent suspension.

With its user-friendly interface and an array of services ranging from mobile recharges to bill payments, online shopping, and peer-to-peer transfers, Paytm quickly found a place in the hearts and smartphones of millions. It raises a fundamental question: why would anyone deactivate the Paytm Postpaid account that has made their lives easier?

In this article, PayCEC will investigate what drives users to close their Paytm accounts and walk you through the process. We will touch upon how the platform responds to user-driven deactivation, including efforts to address concerns, retain users, and provide incentives for account retention.

But that is not all. We will also uncover why and how the platform can deactivate Paytm PostPaid accounts. It is not only about understanding the deactivation but also avoiding having your Paytm account suspended in the first place. Let’s get started.

The Significance of Paytm Postpaid Accounts

In recent years, the digital payments landscape has witnessed a significant evolution, with financial technology companies constantly introducing innovative products and services to cater to the diverse needs of their users. One such development within the Paytm ecosystem is the introduction of Paytm Postpaid.

Paytm Postpaid, a Paytm service, provides customers with a simple and flexible credit alternative, allowing them to make purchases and payments without having instant cash in their Paytm wallet.

It effectively serves as a digital credit line, allowing customers to buy now and pay later. Paytm Postpaid is popular since it provides an interest-free credit period, typically spanning 15 to 45 days. Users may clear their debts without incurring additional fees during this time, making it a handy and cost-effective way to access short-term credit.

Here are the key features and benefits that make this service a game-changer for many users:

- Zero-Interest Credit: One of the primary attractions of Paytm Postpaid is that it offers interest-free credit to users. Users can make purchases and payments without incurring interest charges, making it an affordable and accessible credit option.

- Digital Convenience: Paytm Postpaid eliminates the need for traditional credit cards or loans. Users can avail credit digitally within the Paytm app, streamlining the borrowing process and making it more convenient.

- Flexible Repayment: Paytm Postpaid offers flexible repayment options, allowing users to repay the borrowed amount within a specified timeframe. This flexibility caters to users' varying financial situations and needs.

- Accepted Across the Paytm Ecosystem: Paytm Postpaid is helpful for a wide range of transactions within the Paytm ecosystem. It includes mobile recharges, bill payments, online shopping, and other digital payments.

Why Users Deactivate Paytm Postpaid Accounts

What prompts users to disable their Paytm Postpaid accounts?

Users often worry about the extent of data collected by digital platforms. In the case of Paytm, personal and financial data are collected to facilitate transactions and offer personalized services. Some users may find this data collection intrusive and deactivate their accounts to safeguard their privacy.

In other cases, the platform may proactively deactivate Paytm Postpaid accounts suspected of fraudulent activity to protect the platform and its users. While this is a security measure, it might trouble users.

When users' money habits change, they may no longer see Paytm's features as relevant. This shift can cause them to deactivate Paytm Postpaid services.

How to Deactivate a Paytm Postpaid Account

Deactivating a Paytm account is a straightforward process, but users need to be aware of the steps involved:

- Open the Paytm App: To start the deactivation process, open the Paytm app on your mobile device.

- Login: Ensure you are using the Paytm account for which you want to deactivate Paytm Postpaid.

- Access the Paytm Postpaid Section: In the app, navigate to the "Paytm Postpaid" section, typically under the "My Payments" or "My Money" section.

- Follow the On-Screen Instructions: Paytm will guide you through the process with on-screen instructions. You may need to provide information or complete specific actions to confirm your decision.

- Confirm Deactivation: Once you've followed the instructions and provided the necessary information, confirm your decision to deactivate your account.

- Account Deactivation Confirmation: After confirming your decision, Paytm will typically send a confirmation message to your registered email address or mobile number, acknowledging the deactivation of your account.

Paytm's Response to User Deactivation

A. Reaching out to Users Who Wish to Deactivate

Paytm acknowledges that some users may contemplate deactivating their accounts for various reasons. To address this, Paytm has devised a proactive strategy to reach out to users who want to deactivate Paytm Postpaid.

They employ various means of communication, such as email, SMS, and in-app notifications, to connect with users considering deactivation. This outreach aims to understand the user's concerns and, if possible, provide solutions or alternatives that might encourage them to continue using Paytm.

B. Addressing Concerns and Feedback

Paytm values user feedback and takes user concerns seriously. When users express their reasons for deactivation, Paytm's customer support and dedicated teams strive to address these concerns promptly.

They might give advice, explanations, or solutions, depending on what issues the user raised. Paytm knows that helping users with their concerns is pivotal for making users happy and keeping their trust.

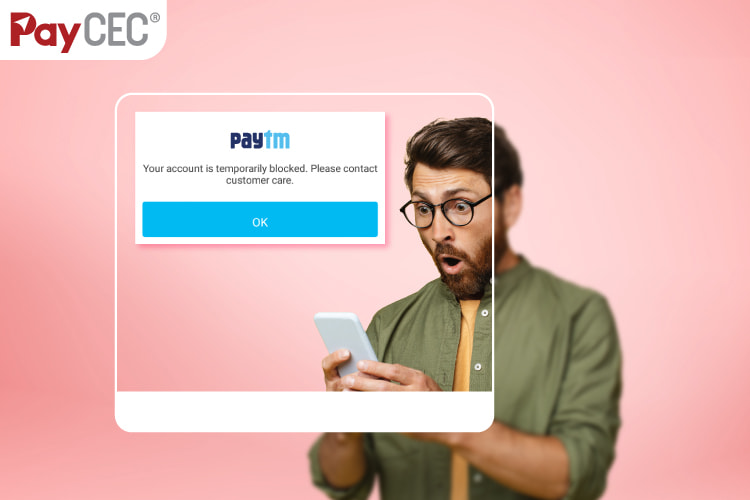

What about Suspended Paytm Accounts?

Paytm suspends accounts for its safety and reliability, citing various reasons for such action.

Just as customers can deactivate Paytm Postpaid service, Paytm reserves the right to suspend an account when necessary. It is an essential part of maintaining the safety and reliability of the Paytm ecosystem.

There are various reasons for Paytm account suspension. For example, verification and documentation issues can arise from inadequate or inaccurate Know Your Customer (KYC) documentation. Users who fail to provide the required identification documents may have their Paytm accounts suspended.

Security concerns and fraudulent activity, such as unauthorized access or unusual transactions, can trigger a protective measure of temporary or permanent suspension. Non-compliance with Paytm's terms and conditions, including unethical or unauthorized activities, can lead to account suspension.

The consequences of a deactivated Paytm account are significant. Users lose access to financial services offered by the platform, impacting their ability to make payments, transfers, and conduct financial transactions. Online shopping and bill payments, which many users rely on Paytm for, may also be disrupted, causing inconvenience and affecting ongoing transactions.

Your Paytm Account is Suspended? Do This Now!

When having your Paytm account deactivated, the first and most crucial step is to stay calm and collected, as immediate actions driven by frustration or confusion can sometimes exacerbate the situation. Instead, focus on contacting Paytm's customer support to understand the cause of deactivation and work towards a solution.

Having a suspended Paytm account can disrupt your financial transactions and daily activities. PayCEC offers a seamless transition by providing an alternative payment solution.

Our rapid activation process ensures you can get back to managing your finances with minimal delay. In just 24 hours, you can have a payment gateway up and running, sparing you the extended setup times that can often be associated with other platforms.

Enjoy speedy and secure checkout services through our Swiftly Simple Integration.

Keeping your money safe in the era of digital payments is critical. It is something PayCEC takes extremely seriously. They employ cutting-edge technology like APIs and blockchain to ensure your transactions are quick and, most importantly, secure.

PayCEC never stands still; we are always one step ahead of the competition. This agility is the wind under your financial wings. You're not simply making payments when you use PayCEC; you're conducting transactions with the certainty that your finance is in the hands of pioneers who never miss a beat in this ever-changing world.

Key Takeaway

In a world where digital banking penetrates our daily lives, deciding to deactivate Paytm Postpaid accounts may raise eyebrows. However, as we have journeyed through the motivations behind it, we have discovered a fascinating world of altering user preferences, privacy concerns, and changed financial patterns.

So, whether you're a user contemplating deactivation or a platform striving to retain your loyal customers, the financial world is filled with constant evolution and innovation. As we navigate these waters, our collective journey is marked by change, trust, and the ever-evolving partnership between fintech pioneers and the people they serve.

Frequently Asked Questions

How to deactivate a Paytm business account?

Business account deactivation ensures your financial concerns with the platform are properly resolved. You can begin to deactivate a Paytm business account by logging in and contacting Paytm's customer service.

Inform them of your desire to deactivate the account, and they will walk you through the process. It is important to note that the procedure may include clearing any outstanding dues or responsibilities you have with Paytm, such as processing fees or unresolved financial transactions.

Upon verifying your request and settling any financial obligations, Paytm will deactivate your business account. It's essential to keep a record of your transactions and payments, ensuring there are no pending issues.

How to deactivate a Paytm Postpaid account?

Deactivating your Paytm account is a simple process, but it's crucial to follow these steps carefully:

- Open the Paytm App: First, launch the Paytm app on your mobile device.

- Log In: Go into the Paytm account you wish to deactivate, ensuring you're working with the correct one.

- Access the Paytm Postpaid Section: Within the app, navigate to the "Paytm Postpaid" section, typically found under "My Payments" or "My Money."

- Follow On-Screen Instructions: Paytm will guide you through the process with clear on-screen instructions. You may be required to provide specific information or complete certain actions to confirm your decision.

- Confirm Deactivation: After following the instructions and furnishing any necessary information, confirm your decision to deactivate your account.

- Account Deactivation Confirmation: Following your confirmation, Paytm will usually send a confirmation message to your registered email address or mobile number, officially acknowledging the deactivation of your account. This confirmation provides peace of mind that your account deactivation has been successful.

How to deactivate a Paytm merchant account?

Deactivating a Paytm merchant account is a process that maintains financial integrity within the platform. Begin by logging into your Paytm for Business app. You will find an option to contact Paytm's customer support. Reach out to them and communicate your intent to deactivate your merchant account.

Paytm's support team will assist you in the deactivation process, which typically includes settling any outstanding financial obligations with the platform. It's vital to ensure that all transactions and dues are addressed to ensure a seamless deactivation.

By following this process and collaborating with Paytm's support team, you will deactivate your merchant account. This action ensures that you resolve all financial matters, maintaining a healthy financial standing with Paytm.

Can I reactivate my Paytm account?

Yes, Paytm allows you to reactivate suspended accounts. Reactivation is often feasible by resolving the grounds for deactivation, clearing any outstanding financial commitments, and according to Paytm's terms and rules.

To reactivate your Paytm account, you need to contact Paytm's customer service and work with them to rectify any difficulties that led to the deactivation. It is advisable to show a commitment to maintaining a safe and compliant environment to restore access to your Paytm account.

Can Paytm be deactivated?

Indeed, you can deactivate your Paytm account. The process is similar for business, Postpaid, and merchant accounts.

It usually entails contacting Paytm's customer service, clearing any financial commitments, and following their instructions for account deactivation. This deactivation procedure is in place to ensure that users may make informed decisions about whether or not to continue using the platform.

It is crucial to emphasize that in most circumstances, deactivation is reversible. If you wish to use Paytm's services again, you can reactivate your account by resolving any pending issues and adhering to their standards.

Why is my Paytm account disabled?

Paytm may ban accounts for several reasons to ensure the platform's security and integrity. The most common causes for account disablement include security concerns, violation of Paytm's terms and policies, and non-compliance with regulatory requirements.

If you find your Paytm account disabled, it's essential to contact Paytm's customer support to understand the specific reasons for the action taken. By working with their support team and addressing the root causes of the disablement, you can often reactivate your account.

Paytm places a high emphasis on maintaining the security and compliance of its platform to protect both users and the overall integrity of its services. Hence, they may deactivate Paytm accounts as a protective measure, ensuring a secure and trustworthy payment environment.

News

Business

Products

who we are

about us

We are honored to serve as your reliable business partner and financial service provider in the industry and other business-related services. With the help of our professional staff, to help merchants to achieve their goals for the development and expansion of the international business market.

Our payment flow has developed in the e-commerce world to perform seamlessly and effectively across all platforms and devices. We take pleasure in combining technology with customer service, to solve your concerns at the moment.

PayCEC is a fully worldwide payment network that not only allows merchants to be paid immediately and securely, but also allows them to withdraw money in multiple currencies to their company accounts.

+65 6631 8332

+65 6631 8332

Processing

Processing