- Hotline +65 6631 8332

PayCEC assists you on your journey towards acquiring the SEPA Credit Transfer - a tool that will help you keep up with the rushing pace of innovation in the sector of payments. With PayCEC’s Credit SEPA Transfer, making payments within the eurozone is so easy.

SEPA mainly consists of:

27 Member States of the European Union (EU).

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

3 countries of the European Economic Area (EEA).

Liechtenstein, Iceland, Norway.

6 non-EEA countries, to which the geographical scope has been extended.

Andorra, Monaco, San Marino, Switzerland, United Kingdom, Vatican City State.

Non-EEA Territories

Saint-Pierre-et-Miquelon, Guernsey, Jersey, Isle of Man.

How long does a SEPA Credit Transfer take?

The length of time for a SEPA Credit Transfer to be completed takes 1-3 business days.

SEPA transfer charges

- Withdrawal fee: €0

- Minimum withdrawal amount: €50

Contact our expert for a tailored offer.

Contact Us

SEPA Transfer Limit to other bank accounts

You can transfer funds from your PayCEC’s

merchant account to other bank accounts

quickly and seamlessly with the optimal transfer amount limit.

| Transaction type | Default limit per day (€) | Daily limit set by user (€) |

|---|---|---|

| Transfer to other local EU bank | 50,000 | Up to 500,000 |

| Transfer to international account - via SWIFT | 50,000 | Up to 500,000 |

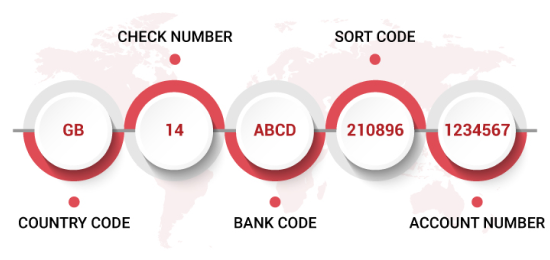

IBAN (International Bank Account Number)

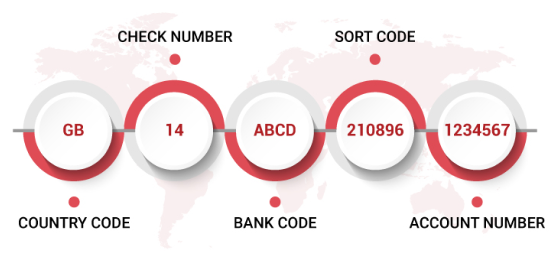

- IBAN is a standard international system for identifying individual bank accounts.

- IBAN numbers consist of up to 34 characters. The first 2 letters indicate the bank's home country, the next 2 are "check digits", then a series of numbers identifies the bank and account.

Merchant Benefits

PayCEC delivers SEPA transfer solution that drive your business’s revenue and profitability.

Ready-made payment gateway for access to SEPA without any intermediary bank.

Issuing unique EURO SEPA IBANs.

IBANs supporting SEPA Credit Transfer.

Get paid quickly with Internet banking transfer payment.

Fees that are lower than international bank transfers.

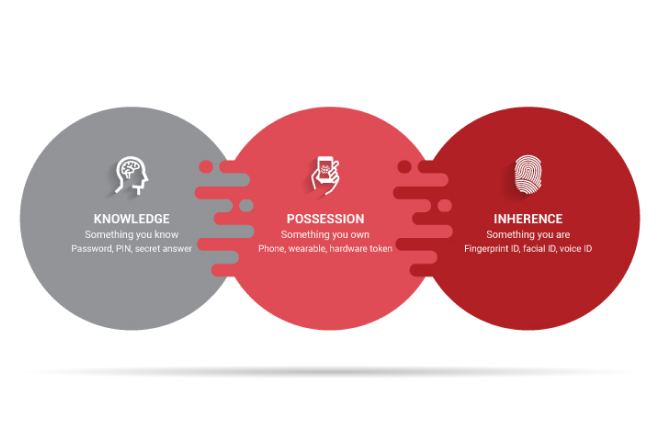

Learn moreProtect against fraud in SEPA payments

- Merchants can check their IBAN number, and verify if it is the correct account number and account owner through the IBAN checker system.

- SCA (Strong Customer Authentication) for extra fraud protection, ensuring the safety and security of payments.

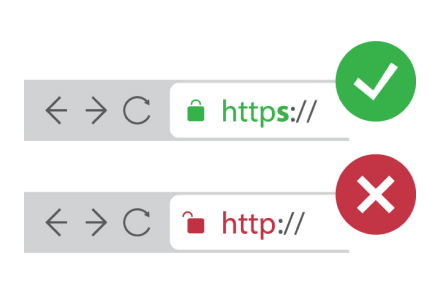

- Your customers' data will always be transferred SSL-encrypted (the address starts with https:// rather than http://). This guarantees a secure connection to SEPA.net.

- Every bank offers transfer limits to protect the customers from hackers in the huge transaction without permission of account holders.

Start collecting SEPA payments

For payee checkout input:

- Name of the merchant or your company (Beneficiary name).

- The purpose of payment (please note your order details, such as order number, sender name… )

- International bank account number (IBAN) of the merchant.

- Country that the customer wishes to send the money to.

- Business identifier code (BIC) (if any).

- Supporting documents (if any due to high volume of orders).

Frequently Asked Questions

Where can I pay with SEPA?

Thanks to the Single Euro Payments Area (SEPA), you can pay with SEPA anywhere in the European Union, as well as a number of non-EU countries, other countries and territories which are part of the geographical scope of the SEPA Schemes.

27 Member States of the European Union (EU):

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

6 non-EEA countries, to which the geographical scope has been extended:

Andorra, Monaco, San Marino, Switzerland, United Kingdom, Vatican City State, Saint-Pierre-et-Miquelon, Guernsey, Jersey, Isle of Man.

3 countries of the European Economic Area (EEA):

Liechtenstein, Iceland, and Norway.

How to do a SEPA payment? / How do I pay by SEPA?

To make SEPA payments, you will need a PayCEC’s SEPA payment gateway and a IBAN (International Bank Account Number) number, which is an internationally agreed system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a lower chance of transcription errors.

An IBAN consists of up to 34 alphanumeric characters comprising a country code, two check digits, and a number that includes the domestic bank account number, branch identifier, and potential routing information.

Even if you don’t live in the SEPA area countries, you can still open a non-resident virtual bank account with an IBAN in Europe, and be able to make Euro transfers without a fee if it’s an internal bank transfer (same bank), and small fee if it’s a transfer between different SEPA bank accounts.

For payee checkout input:

- Name of the merchant or your company (Beneficiary name).

- The purpose of payment (please note your order details, such as order number, sender name… ).

- International bank account number (IBAN) of the merchant.

- Country that the customer wishes to send the money to.

- Business identifier code (BIC) (if any).

- Supporting documents (if any due to high volume of orders).

How to pay by SEPA payment gateway?

SEPA payment system uses the International Bank Account Numbers (IBAN). SEPA payment method with additional optional features or services such as mobile phone or smart card payment systems, are not directly covered. To pay by SEPA payment gateway, you only need to have the payee’s bank details in the international format. Most SEPA transfers arrive in the beneficiary’s bank account within 1-2 business days.

What is the SEPA format?

The Single Euro Payments Area (SEPA) is a system of transactions created by the European Union (EU). The SEPA harmonizes the way cashless payments are transacted between Euro countries. People conducting business in these countries now make cross-border cashless payments at the same cost and convenience as domestic payments thanks to SEPA online payment method.

The SEPA is managed by the European Payments Council on a collaborative basis with the European Commission, the European Central Bank (ECB), and other European stakeholder groups.

There are 36 countries that participate in SEPA, which is a well-established home market area for making cross-border Euro bank transactions. It essentially makes international money transfers easier by making it equivalent to domestic transactions. This means that even if you’re transferring funds between two banks that are in different SEPA countries, you can enjoy a fast transaction and minimal transfer fee.

|

Name |

Single Euro Payments Area. |

|

Implementation year |

2014 for Euro area countries. 2016 for Non-Euro area countries. |

|

Currency |

Euro (€). |

|

Cashless payment instruments |

Credit transfer, direct debit. |

|

Speed of processing |

No longer than 1 business day for electronic payment orders, 2 business days for paper-based payment orders. |

|

SEPA area countries |

36 countries (includes some non-euro area and non-EU countries). |

|

Stakeholders |

European banking and payments industry, payment service users, national governments, the European Commission, the Eurosystem, and several other public authorities. |

Even if you don’t live in the SEPA area countries, you can still open a non-resident virtual bank account with an International Bank Account (IBAN) in Europe and be able to make Euro transfers without a fee if it’s an internal bank transfer (same bank), and small fee if it’s a transfer between different SEPA bank accounts.

IBAN (International Bank Account Number) is an internationally agreed system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a lower chance of transcription errors. It was originally adopted by the European Committee for Banking Standards (ECBS) and afterwards as an international standard.

An IBAN consists of up to 34 alphanumeric characters comprising a country code, two check digits, and a number that includes the domestic bank account number, branch identifier, and potential routing information.

How are SEPA payments processed?

To know how SEPA payments are processed, let’s check out the steps below for your information.

- Step 1: The customer presses a “Purchase” button or relevant button, and fills in the necessary fields to pass the transaction data.

- Step 2: Select your payment method and proceed to payment.

- Credit/Debit card (Visa / MasterCard / Amex / Discover / JCB).

- E-wallet (PayPal).

- Wire bank transfer.

(In case the customer chooses the SEPA Transfer (for European clients) option: When you transfer in Euro currency, it will take 2-5 days. But if your bank is based in countries supported by SEPA Transfer in Euro currency, the process will be faster within 1 - 2 days with cheaper fee).

- Step 3: The customer inputs the required information.

- Beneficiary name (Name of the merchant or your company).

- The purpose of payment (Please note your order details, such as order number, sender name… ).

- International bank account number (IBAN) of the merchant.

- Country that the customer wishes to send the money to.

- Business identifier code (BIC) (if any).

- Supporting documents (if any due to high volume of orders).

- Step 4: The customer proceeds to payment, checks the invoice, and the transaction is completed.

What are the different types of SEPA payments?

There are 2 different types of SEPA payments, which are SEPA credit transfer and SEPA debit transfer. When it comes to SEPA, it is very important to differentiate these two types of SEPA payments. Each one offers a distinct service:

SEPA credit transfer

In SEPA credit transfer, money is transferred in the form of Euro. It transfers cash from one bank to another by the use of IBAN codes (International Bank Account Number), which is an internationally agreed system of identifying bank accounts across national borders to facilitate the communication and processing of cross-border transactions with a reduced risk of transcription errors. Customers in the SEPA area countries utilize it as a one-time payment option for products and services.

SEPA debit transfer

SEPA debit transfer in the SEPA area countries list also uses Euros but it is not a one-time payment method. It is a recurring payment method. The one paying has to authorize payment by providing information about the bank account name and number, IBAN and BIC. The payee has to retain the authorization of the recurring payment. The authorization can either be in electronic or in paper.

The debit transfer in the SEPA area countries list can be set to make recurring payments for a specific number of times or indefinite payments until the authorization is canceled. The set up is done between the customer and the business or between two businesses. For instance, it can be set to pay monthly rent, electricity bill, or other subscription services.

How do I accept SEPA?

PayCEC’s SEPA payment gateway now accepts quick bank transfers within the SEPA network from European banks and payment institutions. PayCEC wants to be featured primarily in the UK, EU markets, and other entities in the US, Canada, and APAC which have IBAN bank accounts. Every PayCEC’s client will have an IBAN business account that can acquire online SEPA transfers from their customers.

These merchant’s IBAN business accounts are able to collect digital banking transfers from all banks in the SEPA scheme countries, including 27 Member States of the European Union (EU), 3 countries of the European Economic Area (EEA), and 6 non-EEA countries, to which the geographical scope has been extended.

To accept SEPA payments, you need to integrate PayCEC SEPA Payment Gateway.

Does PayCEC accept SEPA?

Yes, PayCEC’s SEPA Payment Gateway now accepts quick bank transfers within the SEPA network from European banks and payment institutions. PayCEC wants to be featured primarily in the UK, EU markets, and other entities in the US, Canada, and APAC which have IBAN bank accounts. Every PayCEC’s client will have an IBAN business account that can acquire online SEPA transfers from their customers.

These merchant’s IBAN business accounts are able to collect digital banking transfers from all banks in the SEPA scheme countries, including 27 Member States of the European Union (EU), 3 countries of the European Economic Area (EEA), and 6 non-EEA countries, to which the geographical scope has been extended.

What is the SEPA payment gateway?

SEPA allows customers to make cashless Euro payments to any banking account and anywhere as long as they are inside SEPA's supported territory. PayCEC launched its ready-made SEPA payment gateway that enables merchants to access SEPA without any intermediary bank.

PayCEC offers the lightning-fast and most secure SEPA payment gateway with hassle-free integration for merchants to accept SEPA payments from customers' accounts in 36 SEPA countries and associated territories. Besides, PayCEC’s SEPA payment gateway fee is considered cost-efficient as it is lower than international bank transfers.

|

Name |

Single Euro Payments Area. |

|

Implementation year |

2014 for Euro area countries. 2016 for Non-Euro area countries. |

|

Currency |

Euro (€). |

|

Cashless payment instruments |

Credit transfer, direct debit. |

|

Speed of processing |

No longer than 1 business day for electronic payment orders, 2 business days for paper-based payment orders. |

|

SEPA area countries |

36 countries (includes some non-euro area and non-EU countries). |

|

Stakeholders |

European banking and payments industry, payment service users, national governments, the European Commission, the Eurosystem, and several other public authorities. |

With PayCEC’s SEPA payment gateway, start collecting payments within the eurozone is so easy.

Is Serbia in SEPA zone (Is Serbia a SEPA country)?

NO. Serbia is not a member of SEPA payment schemes. International payments in and out of Serbia need to be made via a wire transfer banking network. Fees might be higher than within the SEPA network.

Banking in Serbia is regulated by the central bank the National Bank of Serbia. If you need to transfer money to Serbia, you'll have fewer options than in many other EU nations.

To transfer money from and to Serbia, you need to use international bank transfer digital or over the counter services. There are a variety of options for you to choose namely SWIFT transfer, wire transfer, pay via e-wallet like Paypal or international credit cards (Visa, Mastercard, American Express)

Is Ukraine a SEPA country (Is Ukraine part of SEPA)?

NO. Ukraine is not a member of SEPA payment schemes. International payments in and out of Ukraine need to be made via a wire transfer banking network. Fees might be higher than within the SEPA network.

Within Ukraine, modern opportunities for domestic remittances are plentiful. You are able to use one of the most comfortable and practical methods to initiate bank transfers such as:

- Transfer from card to card entails the capacity to transfer funds to any Ukrainian financial institution's debit or credit bank card.

- Banking on the internet FreeBank is an independent online money transfer service that allows you to transfer money between your own accounts and from one account to another, including from one bank to another.

- Freesend is a bank transfer system that allows you to send money across Ukraine using a network of regional offices.

Is the USA a SEPA country (Is the USA part of SEPA)?

NO. The US has another payment system in North America. SEPA mainly consists of

- 27 Member States of the European Union (EU)

- 3 countries of the European Economic Area (EEA)

- 6 non-EEA countries, to which the geographical scope has been extended

Is Romania a SEPA country (Is Romania part of SEPA)?

YES. Romania is a SEPA country. Romania is a member of the Single Euro Payments Area (SEPA). In SEPA systems such as domestic transfers, you can make payments or receive payments in real-time from other countries. You can also take advantage of open banking features and low payment fees.

Since January 1, 2007, Romania has been a member of the European Union. The Romanian Association of Banks supervises the implementation, operation, and development of national payment schemes based on European standards, including the SEPA Instant Credit Transfer RON scheme, in accordance with the central bank's mandate and the licence agreement signed with the European Payment Council.

The IP system in Romania was established in close collaboration with Romanian credit institutions, the National Bank of Romania, and the Romanian Association of Banks by Transfond, the owner and operator of the automated clearing house for interbank commercial payments.

Banks can provide payment services to their customers – both consumers and businesses – 24 hours a day, 7 days a week, 365 days a year, up to a maximum of 49,999 RON in under 10 seconds, all in a secure environment, using the IP service. The European Payments Council ( EPC) established the SEPA Instant Credit Transfer mechanism, which is used by the service.

What is the IBAN code in Romania?

IBAN in Romania consists of 24 characters:

- 2 letters country code

- 2 digit check number

- 4 characters from the bank's bank code

- 16 digit code for the bank account number

| IBAN | RO49 AAAA 1B31 0075 9384 0000 |

| ISO Country Code | RO (Romania) |

| IBAN Check Digits | 49 |

| Bank Identifier | AAAA |

| Account Number | 1B31007593840000 |

| SEPA Member | Yes |

Is Switzerland a SEPA country (Is Switzerland part of SEPA)?

YES. Although Switzerland is not a member of the European Union, the nation is a member of SEPA payment schemes. Therefore, payment instructions and banking transactions in Switzerland are similar to other EU countries within the SEPA Schemes’ Geographical Scope.

Within the SEPA, SEPA transfers can be utilized to perform euro transactions. E-banking, datalink, and SWIFT services are all available for transfers.

Because SEPA transactions are a standardized money transfer method, Swiss banks typically undertake them for free or at a substantially lower cost than foreign currency transfers.

A SEPA transaction must meet the following criteria:

- Payments in euro

- IBAN of the account to which money is being transferred

- BIC of the bank to which money is being transferred (bank must be SEPA compatible)

- Shared (SHA) billing is used: fees are shared between the sender and the recipient

Important: If a transaction does not match the above requirements, it will be executed as a normal international transfer, which is typically far more expensive.

Standard IBAN Format in Switzerland

The IBAN for Switzerland is shown below. It has a total of 21 characters. A thorough breakdown of the IBAN structure in Switzerland can be seen below.

- 2 letters ISO country code

- 2 digits IBAN check digits

- 5 digits bank code

- 12 characters account number

| CH | 93 00762 011623852957 |

| Country | CH |

| IBAN Checksum | 93 |

| Bank Code | 00762 |

| Account Number | 011623852957 |

Is Germany a SEPA country (Is Germany part of SEPA)?

YES. Germany is a SEPA country. You can make payments or get paid from other countries in the SEPA schemes like domestic transfers in real-time. You also enjoy the benefits of open banking features and cost-effective payment fees.

In addition, most banks in Germany allow you to transfer money worldwide using a SWIFT (Society for Worldwide Interbank Financial Telecommunication) code. You can do this either online, by using a bank app, or by visiting a branch in person.

Many people choose to manage their accounts through online and mobile banking rather than going to the bank in person since it is more convenient. Fortunately for expats in Germany, most banks provide online and mobile banking through websites and mobile apps.

In addition, in recent years, a number of online-only and mobile-only banks have developed, including the following:

- bunq – a website and mobile banking app

- N26 – a website and mobile banking app

- Revolut – a website and mobile banking app

- DKB – the second-largest direct bank in Germany

- ComDirect – the third-largest direct bank in Germany

- Santander – offers online and telephone banking services

What is the IBAN code in Germany?

IBAN in Germany consists of 22 characters:

- 2 letters country code

- 2 digit check number

- 8 digits for the bank code (BLZ code)

- 10 digit code for the bank account number

| IBAN | DE89 3704 0044 0532 0130 00 |

| ISO Country Code | DE (Germany) |

| IBAN Check Digits | 89 |

| BBAN | 3704 0044 0532 0130 00 |

| Bank Identifier | 37040044 |

| Account Number | 0532013000 |

| SEPA Member | Yes |

Is Turkey a SEPA country (Is Turkey part of SEPA)?

NO. Turkey is not a member of the SEPA scheme. Turkey has its own payment system which is operated by the Turkish Central bank (CBRT). To make a wire transfer to other countries from Turkey, you need to use an interbank transfer system such as SWIFT.

Payment and Securities Settlement Systems Operated by the Central Bank

- Electronic Fund Transfer System (EFT)

- Turkish Lira Interbank Payment System

- Turkish Lira Customers Payment System

- Electronic Securities Transfer System (ESTS)

- The Instant and Continuous Transfer of Funds (FAST) System

Payment and Securities Settlement Systems Licensed by the CBRT

- Interbank Card Center (BKM) - Domestic Clearing and Settlement System

- Istanbul Clearing, Settlement and Custody Bank Inc. (TAKASBANK)

- Equity Market Clearing System

- Debt Securities Market Clearing System

- Takasbank Cheque Clearing System

- Central Registry Agency (MKK) - Central Registry System

- Garanti Payment Systems Inc. (GÖSAŞ) - Takasnet System

- Paycore Payment Services Clearing and Settlement Systems Inc. (Paycore) - Paycore Clearing System

- Bileşim Financial Technologies and Payment Systems Inc. (Bileşim Inc.) - TAM Clearing Settlement System

Is Norway a SEPA country (Is Norway part of SEPA)?

Yes, Norway is a member of the SEPA zone.

| IBAN example in Norway: | NO 93 8601 1117 947 |

| ISO Country Code: | NO (Norway) |

| IBAN Check Digits: | 93 |

| BBAN: | 8601 1117 947 |

| Bank Identifier: | 8601 |

| Account Number: | 111794 |

| BBAN Check Digit(s): | 7 |

| SEPA Member: | Yes |

What is SEPA in France?

France is a member of the SEPA zone. The SEPA payment network replaced existing national systems, enabling consumers, businesses, retailers and public administrations to make payments throughout the EU as easily as in France.

| IBAN example in France: | FR1420041010050500013M02606 |

| IBAN in print format | FR14 2004 1010 0505 0001 3M02 606 |

| Country code | FR |

| Check digits | 14 |

| Bank code | 20041 |

| Branch code | 01005 |

| Bank account number | 0500013M026 |

| National check digit | 06 |

Is Sweden a SEPA country?

Yes, Sweden is a member of the SEPA zone.

| IBAN example in Sweden | SE4550000000058398257466 |

| IBAN in print format | SE45 5000 0000 0583 9825 7466 |

| Country code | SE |

| Check digits | 45 |

| Bank code | 500 |

| Bank account number | 00000058398257466 |

What is the SEPA zone?

With the help of national governments, the European Commission, the Eurosystem, and other public bodies, the European banking and payments industry created SEPA.

The SEPA zone is made up of 36 European countries, including those that are not members of the Eurozone or the European Union (status: 30 October 2020).

Which European countries are not in SEPA? (Non SEPA countries list)

The European Payment Council established SEPA credit and debit transfers as a way to improve international payment processing and set standards within SEPA and its 36 member countries. Service providers must be formal participants in the SEPA scheme in order to use SEPA credit and debit transfers.

Countries that do not belong to the list of 36 member countries are not in SEPA (Non SEPA countries list).

| EU/EEA SEPA Countries | Non-EEA SEPA Countries |

| Austria | Andorra |

| Belgium | Monaco |

| Bulgaria | San Marino |

| Croatia | Switzerland |

| Cyprus | United Kingdom |

| Czech Republic | Vatican City State |

| Denmark | |

| Estonia | |

| Finland | |

| France | |

| Germany | |

| Greece | |

| Hungary | |

| Iceland | |

| Ireland | |

| Italy | |

| Latvia | |

| Liechtenstein | |

| Lithuania | |

| Luxembourg | |

| Malta | |

| Netherlands | |

| Norway | |

| Poland | |

| Portugal | |

| Romania | |

| Slovakia | |

| Slovenia | |

| Spain | |

| Sweden | Non-EEA Territories: Saint-Pierre-et-Miquelon, Guernsey, Jersey, Isle of Man |

Special territories which are not part of SEPA countries list 2022 (Non-SEPA countries list):

| Cyprus: Northern Cyprus is excluded. |

| Denmark: the Faroe Islands and Greenland are excluded. |

| France: the French Southern and Antarctic Lands, French Polynesia, New Caledonia and Wallis and Futuna are excluded. |

| Netherlands: Aruba, the Caribbean Netherlands, Curaçao and Saint Martin are excluded. |

| Norway: Svalbard and Jan Mayen are excluded. |

| United Kingdom: British Overseas Territories are excluded, save for Gibraltar and the Crown dependencies. |

Is the UK a SEPA country? (Has the UK left SEPA?)

SEPA allows businesses to conduct euro transfers to participating countries via direct debits and direct credits via a single bank account and a standardized set of regulations.

Despite the fact that the United Kingdom has exited the European Union as a result of Brexit, it is still a member of the Single Euro Payments Area (SEPA).

In principle, little has changed in terms of how businesses utilize SEPA, however, there are a few extra details which are now necessary to make SEPA payments from the UK to the EU and vice versa.

As a result of the Brexit changes, the SEPA payment instruction from the corporate's bank must now contain the postal address of the creditor bank.

For credit payments (SCT and SEPA Instant Credit Transfer), the originator's full address and the Beneficiary Bank's BIC code must be included.

The entire address details of the respondent, as well as the BIC code of the Depositor Bank, are required for Direct Debit (SDD Core and B2B) collections from the creditor.

What are your support hours?

Our team of dedicated experts is on hand 24/7 to assist with any technical queries, and offer practical assistance and guidance via live chat, phone, ect. whenever you need it.

Where can I get further information on SEPA Credit Transfer?

Visit our website https://www.paycec.com and social media channels

for more information, or you can contact our expert for details. We have a highly engaged in-house team that is standing by ready to serve you.

With PayCEC payment gateway comes along with dedicated support, you can boost your online business by providing a flexible and secure crypto payment gateway with no worries, and your customers will no longer go away because their favorite payment methods are accepted now!

Are SEPA payments only in Euro?

Yes. PayCEC’s SEPA Credit Transfer allows customers to make cashless Euro payments to any banking account and anywhere as long as they are inside SEPA's supported territory.

How soon will I get my money after the SEPA transaction is processed?

The SEPA Credit Transfer takes 1 - 3 business days.

What are the SEPA Credit Transfer limits?

| Transaction type | Default limit per day (€) | Daily limit set by user (€) |

|---|---|---|

| Transfer to other local EU bank | 50,000 | Up to 500,000 |

| Transfer to international account - via SWIFT | 50,000 | Up to 500,000 |

What does an IBAN look like?

IBAN numbers consist of up to 34 characters. The first 2 letters indicate the bank's home country, the next 2 are "check digits", then a series of numbers identifies the bank and account.

What is an IBAN number (International Bank Account Number)?

- IBAN (International Bank Account Number) is an international account code established by the International Organization for Standardization (ISO) and the European Committee for Banking Standards to facilitate international transactions and eliminate errors during money transfers.

- The IBAN consists of a code that identifies the nation in which the account is located, the account holder's bank, and the account number.

- IBAN simplifies and expedites the processing of cross-border payments. IBAN numbers were solely used for money transfers between European countries. IBAN, on the other hand, is trusted by many countries around the world because of its convenience and accuracy.

Which countries make use of SEPA Credit Transfer?

There are currently 36 SEPA member states:

- EU/EEA SEPA Countries: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

- Non-EEA SEPA Countries: Andorra, Monaco, San Marino, Switzerland, United Kingdom, Vatican City State.

- Non-EEA Territories: Saint-Pierre-et-Miquelon, Guernsey, Jersey, Isle of Man.

What is the SEPA transfer payment gateway?

SEPA's purpose is to improve cross-border payment efficiency, and to merge formerly fragmented national markets of Euro payments into a single domestic market.

SEPA allows customers to make cashless Euro payments to any banking account and anywhere as long as they are inside SEPA's supported territory.

PayCEC offers the lightning-fast and most secure SEPA payment gateway with hassle-free integration for merchants to accept SEPA payments from customer's accounts in 36 SEPA countries and associated territories.

Do you plan on collecting money across borders?

Ready to get started?

We would love to help you get started and support you along the way.

who we are

about us

We are honored to serve as your reliable business partner and financial service provider in the industry and other business-related services. With the help of our professional staff, to help merchants to achieve their goals for the development and expansion of the international business market.

Our payment flow has developed in the e-commerce world to perform seamlessly and effectively across all platforms and devices. We take pleasure in combining technology with customer service, to solve your concerns at the moment.

PayCEC is a fully worldwide payment network that not only allows merchants to be paid immediately and securely, but also allows them to withdraw money in multiple currencies to their company accounts.

+65 6631 8332

+65 6631 8332

Processing

Processing